Protecting Your International Real Estate Investments: 11 Security Strategies

December 16, 2023

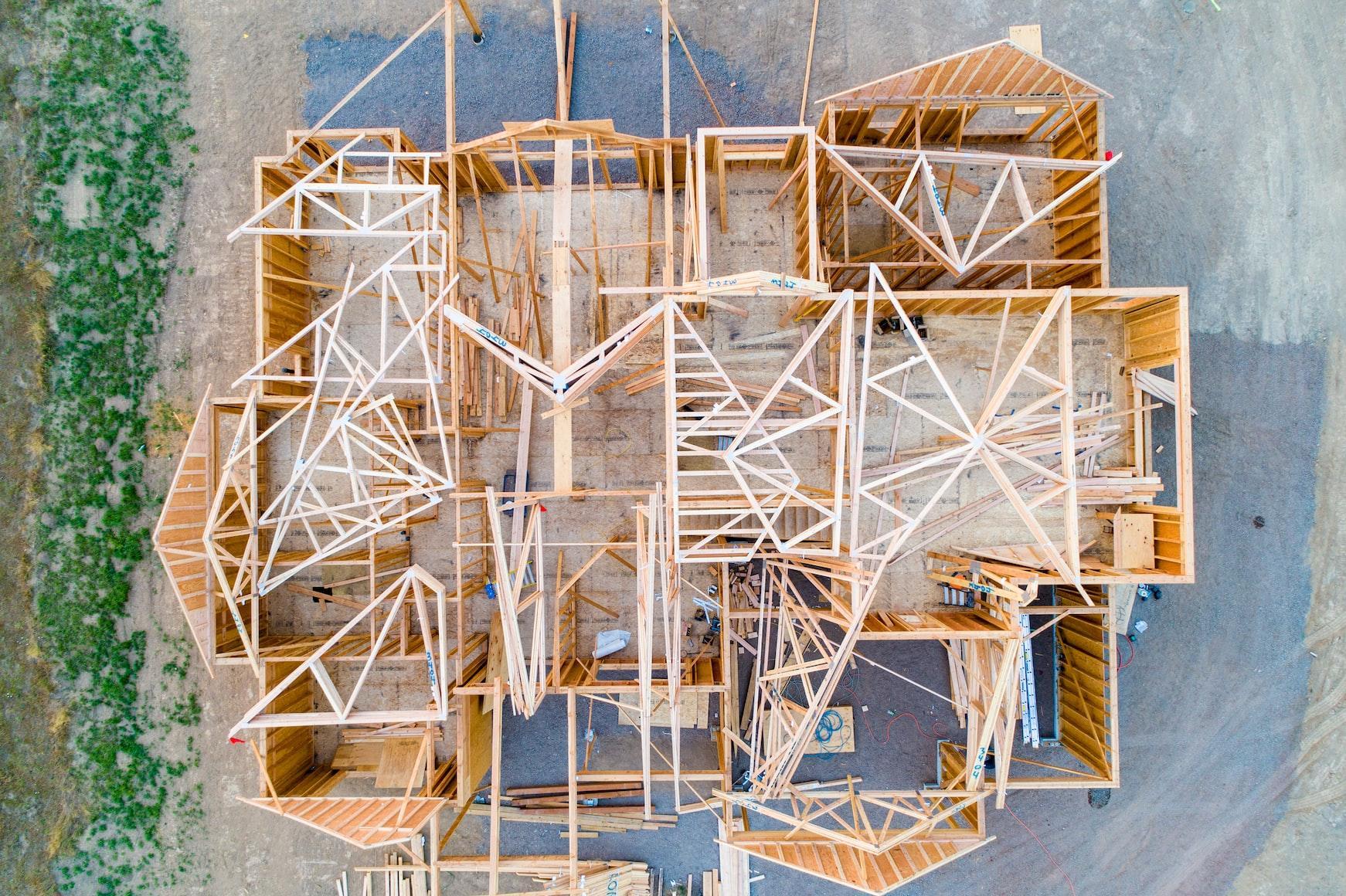

Properties in Costa Rica

As our global economy becomes increasingly interconnected, it’s no surprise that international real estate has become a popular asset class for investors looking to diversify their portfolios. Still, along with great potential rewards come significant risks.

Investing in properties abroad exposes you to various risks, such as currency fluctuations, political instability and remote security challenges. To protect your investments in the international market, it’s crucial to implement robust security strategies.

Here are eleven strategies that can help safeguard your international real estate investments:

1. Thorough Due Diligence

Before investing in any property abroad, it’s essential to conduct comprehensive due diligence. This involves researching the country’s political stability, economic conditions, and real estate market trends. Additionally, it’s crucial to understand the legal framework governing property rights and foreign ownership; familiarize yourself with the history and current condition of the property, while also identifying any potential for legal disputes.

2. Seek Local Expertise

Engaging with local real estate experts, such as lawyers, realtors, and property managers, can prove invaluable when navigating foreign markets; their insider knowledge will help you navigate complexities specific to purchasing and managing property in a foreign country.

3. Consider Political Risk Insurance

Political risk insurance acts as protection for your investment against risks like expropriation, political violence, and currency inconvertibility; this type of insurance becomes particularly crucial in regions with unstable political environments.

4. Diversify Your Investments

Avoid putting all your eggs in one basket by diversifying your real estate investments across different countries and regions; this approach mitigates risk in case one investment faces challenges due to local issues.

5. Manage Currency Risk

Currency fluctuations have a significant impact on the value of international investments, so utilize hedging strategies and consider investing in currency diversification to protect against unfavorable currency movements.

6. Carefully Structure Your Investments

Choosing the appropriate structure for holding your international real estate is vital. Whether it’s through direct ownership, a corporation, a trust, or a partnership, each structure has tax implications and liability considerations; selecting the right structure will offer the most protection for your assets.

7. Regular Monitoring and Management

Stay informed about market conditions and performance related to your international investments. Regularly review and manage your portfolio, paying attention to market trends, property conditions, and tenant issues.

8. Ensure Legal Compliance

Complying with local laws and regulations related to your international real estate activities is essential; failure to do so can result in some whacking great fines, legal disputes, or even the loss of your property.

9. Develop an Exit Strategy

It’s crucial to have a clear exit strategy for each investment you make, so be sure to understand the market conditions and legal processes involved in selling the property. Being prepared allows you to exit the investment quickly if necessary.

10. Prioritize Cybersecurity Measures

In today’s digital age, online communications and data storage play a significant role in real estate transactions and management. Protect sensitive information by implementing robust cybersecurity measures to prevent fraud and data breaches.

11. Get the Physical Security Right

While implementing financial safeguards is critical when protecting international properties, physical security measures are equally important for ensuring safety within the property and amongst its residents. Implementing robust home and multi-family residential security solutions is crucial in deterring crime, monitoring activities, and providing a safe environment for tenants.

Here are key components to consider:

Access Control Systems

Implementing access control systems is a fundamental step in securing properties, particularly multifamily developments. These systems restrict entry to authorized individuals through key cards, fobs, or biometric scanners, as well as provide a record of individuals who enter and exit the building, adding accountability and traceability.

Surveillance Cameras

Closed-circuit television (CCTV) cameras act as a deterrent to criminal activity and enable monitoring of common areas, entrances, exits, and parking structures. Modern surveillance systems can be remotely accessed and managed, allowing for real-time management from anywhere in the world.

Intrusion Detection Systems

Intrusion detection systems, including door and window sensors, motion detectors, and glass break sensors, alert property managers and security personnel to any unauthorized access attempts. These systems can be integrated with the property’s central security system and monitored 24/7.

Lighting

Adequate lighting is a simple yet effective security measure. Well-lit exteriors, hallways, stairwells, parking lots, and other common areas significantly reduce the risk of crime; motion-activated lighting can also serve as an energy-efficient security measure.

Intercom Systems

Audio and video intercom systems allow tenants to verify visitors before granting access. This additional layer of security prevents unauthorized individuals from entering the property.

Security Patrols

Depending on the size and location of your property, hiring security personnel for patrols can be a valuable investment. Security guards can respond quickly to incidents, provide assistance to residents, and deter criminal activity through their presence alone.

Emergency Preparedness

Ensure that your property has clear emergency protocols in place. This includes evacuation routes, fire alarms, and emergency communication systems; regular drills and tenant education also help prepare everyone for unexpected situations.

Cybersecurity for Smart Security Systems

If your property employs smart security systems, it’s vital to protect these systems from cyber threats. Use strong, regularly updated passwords for all systems, and consider using a virtual private network (VPN) for remote monitoring.

Tenant Involvement

Engaging with tenants regarding security measures is essential. Well-informed, vigilant residents serve as additional eyes and ears, reporting suspicious activity and adhering to security protocols.

Regular Maintenance and Updates

Security systems require regular maintenance and updates to remain effective. Assess and upgrade your security measures regularly to keep up with technological advancements and emerging threats.

Incorporating these physical security measures is an essential aspect of protecting your international real estate investments. By combining financial risk management strategies with comprehensive security systems, you can provide a safe living environment for tenants and protect the value of your property against potential threats.

Final Thoughts

Investing in international real estate can be highly lucrative, but it does require a proactive approach to risk management. The key to success in international real estate investing lies in three things: knowledge, planning, and vigilance. It’s vital to safeguard your investments with a superior combination of strategies that are thoughtfully implemented to significantly reduce risks.

Photo credits:

- Photo by Kyle Glenn on Unsplash

- Photo by Jason Leung on Unsplash

- Photo by Fernando Álvarez Rodríguez on Unsplash